When you choose to begin a business endeavor, there are a myriad of things to think about. You have potentially currently picked the function of your endeavor and exactly what it is you are going to make, do, or offer. You have actually most likely experimented with exactly what to call your business. Now exactly what is next? Where do you go from here? We spoke to the business & contracts law experts at McGrath & Spielberger to learn more:

We routinely help small company owners, particularly start-up services, strolling them through the actions that have to be taken in order to make business authorities and legal entities. There are lots of methods of which a business can be arranged and there are non-tax elements, tax elements, and state statutory requirements that have to be considered when starting this amazing journey of beginning a business.

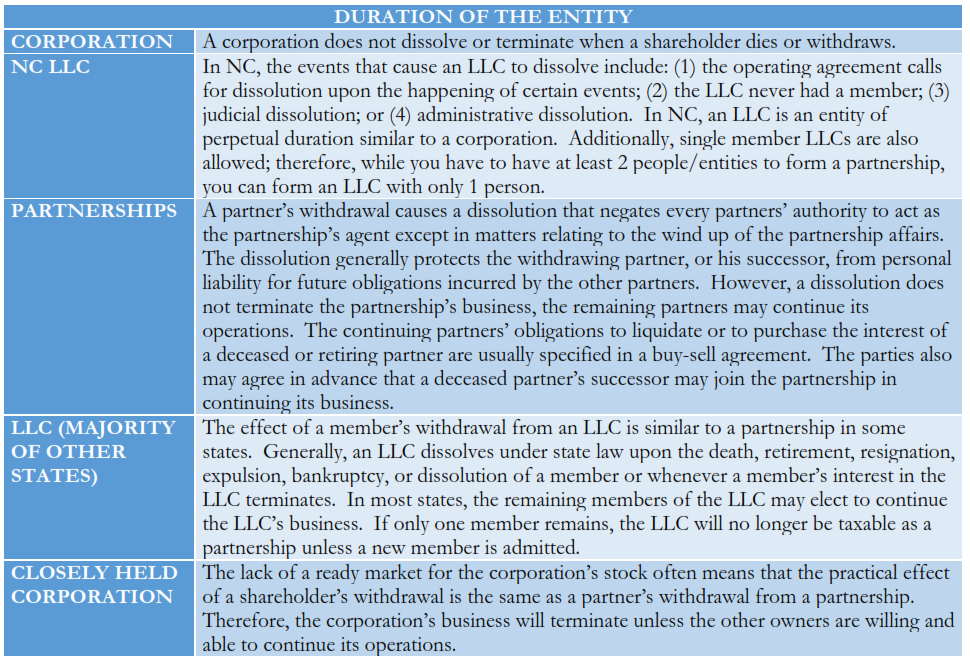

This short article concentrates on a few of the non-tax aspects that have to be thought about. A follow-up post will go over the tax elements of arranging your business. Much of the info in this short article connects to the laws in a bulk of jurisdictions together with examples of particular circumstances where North Carolina law is altered from most other jurisdictions.

The statutory requirements of beginning a business are state particular, for that reason it is very important to look for the support of a specialist who understands the law in your jurisdiction. There are likewise state and regional licensing along with registration requirements that will have to be fulfilled depending upon the jurisdiction your business will be found in. Contracts and agreements may also need to be updated depending on your location, make sure to speak to a experienced contract law attorney to learn more.

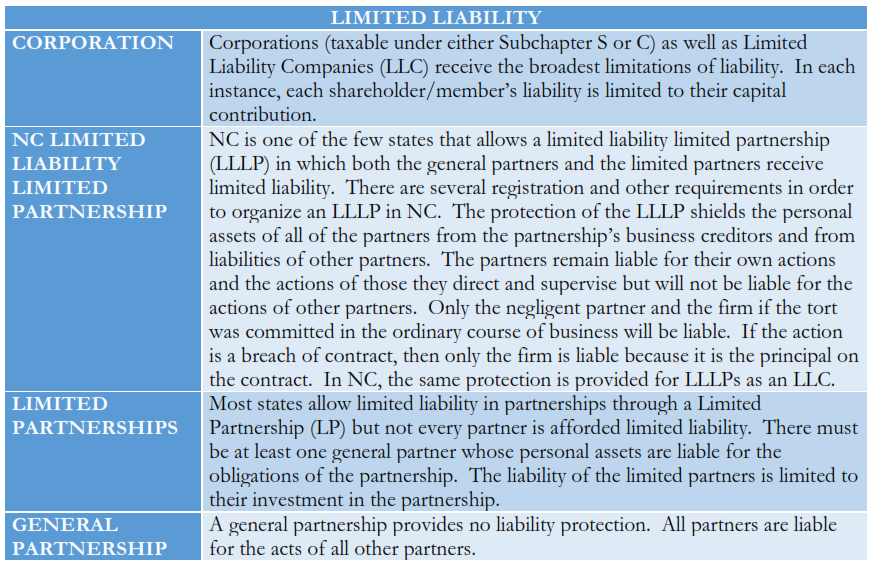

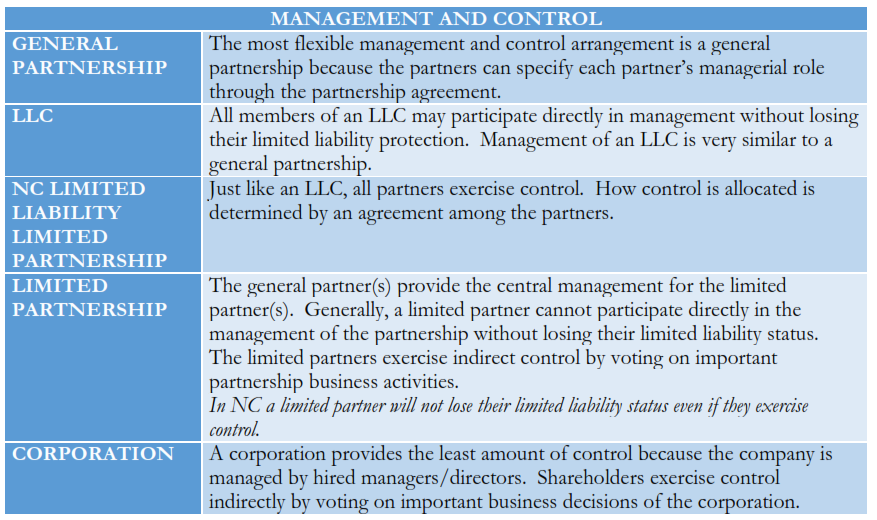

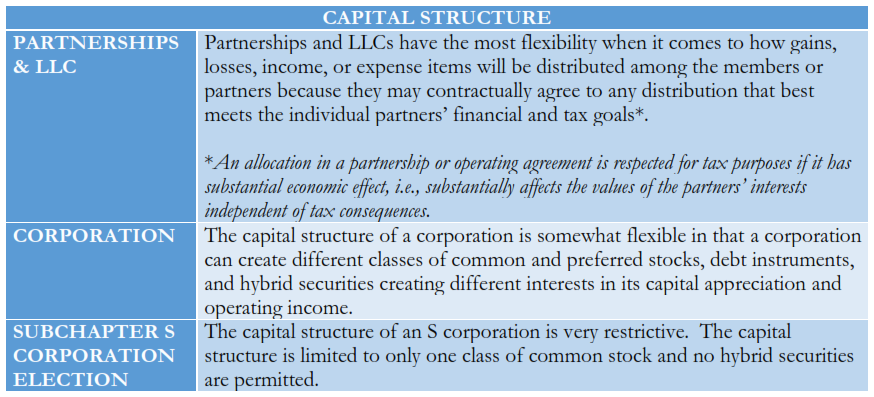

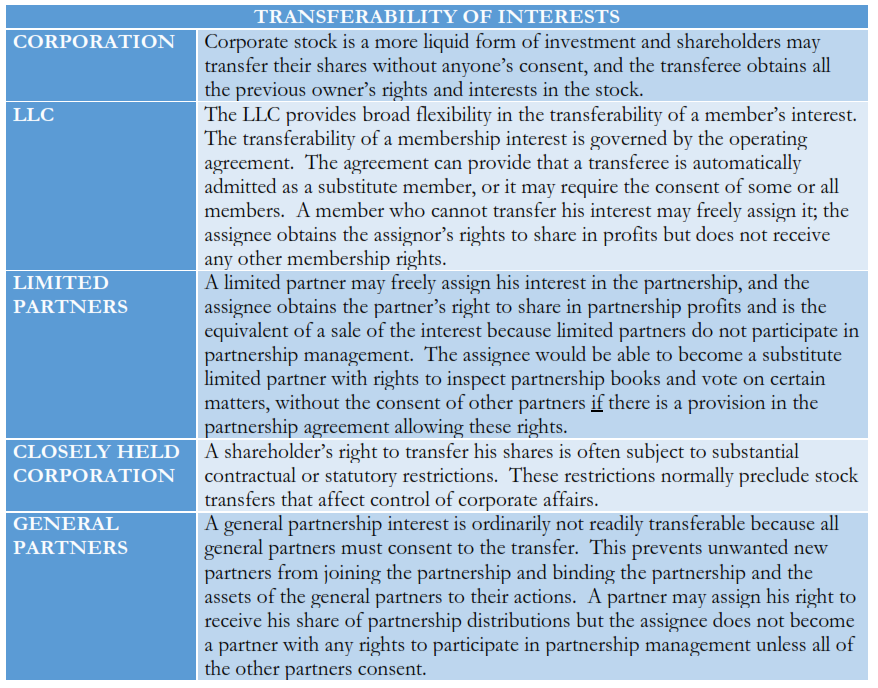

In the tables listed below the entities are noted from the broadest/most versatile to the most limiting.

Limited liability is most likely the most demanded characteristic of entrepreneur forming a brand-new business endeavor. Brand-new entrepreneur want to safeguard their individual possessions from the claims of business lenders. This can typically be attained by arranging the endeavor under a state law that restricts the owners’ liability to the amount of capital the owner has actually purchased the entity. Be really cautious when capitalizing business and getting loans. Some lending institutions might need that the owner(s) of business supply an individual assurance for business responsibilities, thus making the owner liable to those financial institutions of business and beating the function of the constraint of liability.

Lawyers at McGrath & Spielberger, PLLC help customers with all sorts of tax, business, and estate preparation matters in North Carolina. Make certain to call us regarding your tax, business, or estate preparation matter today.